KOHO Taps Boxo To Launch Global Remittance Mini-App

Editorial Team

•

Boxo

How KOHO Launched a Global Remittance Mini-App with Boxo

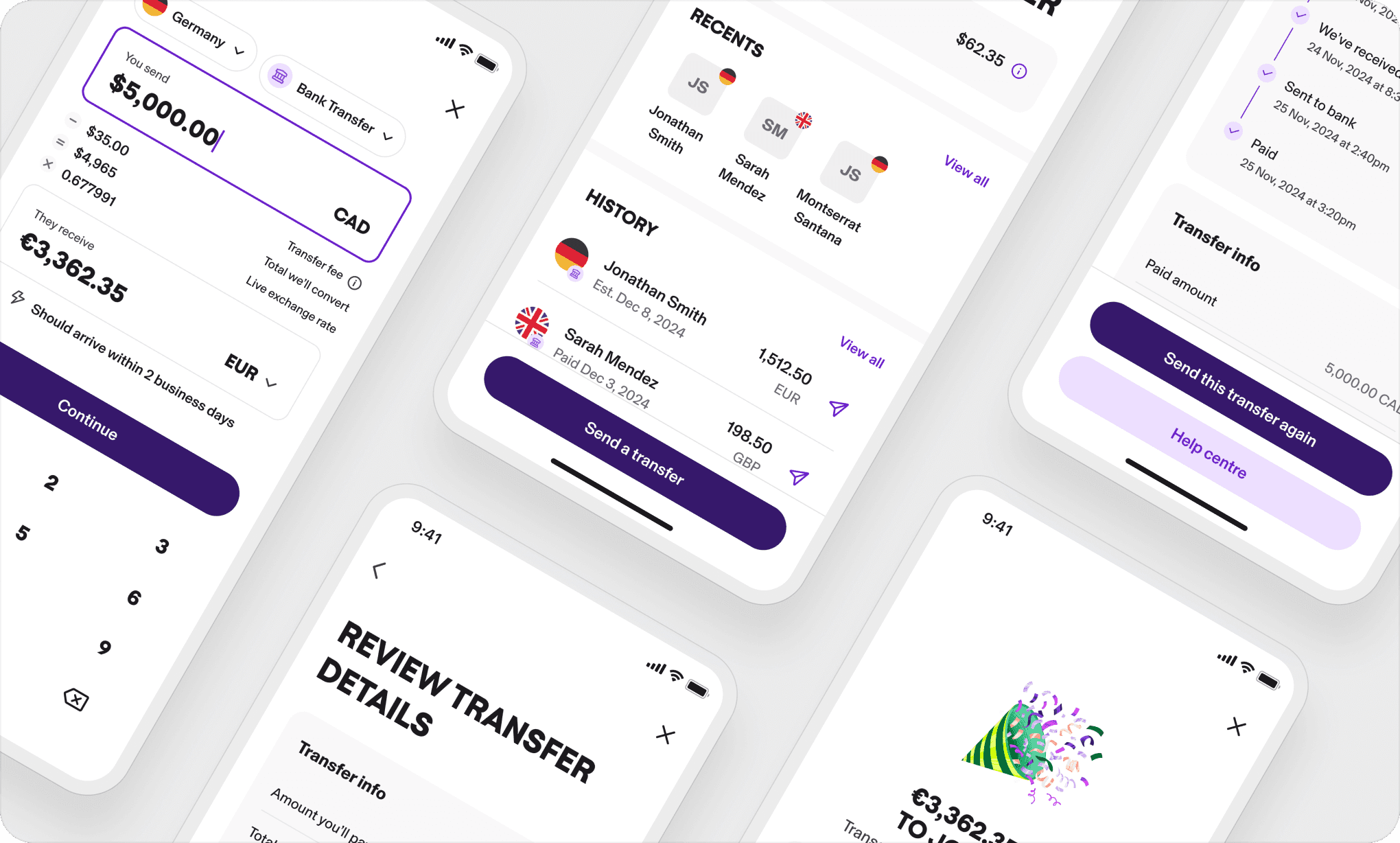

In May 2025, KOHO—one of Canada’s fastest-growing modern financial apps—launched a cross-border remittance service directly inside its mobile application. Fully powered by Boxo and enabled through Nium’s global payment infrastructure, KOHO’s new remittance mini-app gives its users an easier, faster, and more transparent way to send money abroad.

This integration marks KOHO’s first major expansion into international money movement and represents a significant step toward building a broader ecosystem of financial services inside the KOHO app.

Why Remittance Matters

Remittances are a critical part of Canada’s financial landscape. With one of the world’s largest immigrant populations, millions of Canadians send money overseas each year to support family, cover bills, or contribute to communities back home. Yet despite the importance of these flows, traditional remittance channels are often slow, fragmented, and expensive.

Users frequently encounter:

Complex fees and unclear FX mark-ups

Long settlement times

Limited payout options

The need to rely on multiple apps or in-person agents

For a fintech like KOHO—whose mission is to bring transparency, simplicity, and fairness to personal finance—solving these pain points was a natural next step.

Introducing KOHO

KOHO is a Canadian fintech offering a reloadable Mastercard card, cash-back rewards, automated budgeting tools, and flexible savings features. Designed for everyday use, KOHO has built a loyal user base across newcomers, young professionals, gig workers, and families. Its focus on accessible money management positioned KOHO perfectly to expand into international transfers.

But launching a global remittance service from scratch—complete with compliance, payout networks, FX infrastructure, fraud controls, and user experience design—would typically take years. KOHO needed a partner who could deliver an end-to-end solution inside its mobile app with speed and reliability.

That partner was Boxo.

A Seamless Integration: Powered by Boxo

KOHO’s remittance feature lives directly within the KOHO mobile application, integrated through the Boxo mini-app platform. This allows KOHO to offer a native, in-app experience without building the remittance engine internally.

What Boxo provided:

A fully designed, custom-branded remittance storefront

End-to-end development, integration, and quality assurance

Transaction routing and orchestration

Real-time monitoring, dashboards, and operational tooling

A scalable mini-app architecture allowing KOHO to add more services over time

To power the global remittance rails, Boxo integrated KOHO with Nium, a world-leading cross-border payments provider. Through Nium, KOHO gained access to one of the widest international payout networks available in consumer fintech.

Global Reach: Over 200 Countries Supported

At launch, KOHO users could send money to over 200 countries and territories, giving the product one of the largest geographic footprints of any Canadian fintech remittance offering.

This includes major corridors such as:

India

Philippines

China

Pakistan

Nigeria

Vietnam

Bangladesh

And most of Europe and Southeast Asia

The initial launch supports bank-to-bank transfers, requiring SWIFT or equivalent banking details—an ideal foundation for global coverage and regulatory alignment.

Early Adoption and Performance

Since going live in May 2025, KOHO’s remittance mini-app has demonstrated strong demand:

Over 15,000 processed transactions

Over 10,000,000 CAD in remittance volume

These early numbers show clear product-market fit and highlight how deeply KOHO users value having international transfers embedded within their primary financial app.

Why KOHO Chose Boxo

KOHO selected Boxo based on a strong existing partnership. In 2024, Boxo successfully delivered KOHO’s eSIM mini-app, which has since connected over 20,000 users worldwide. That integration proved Boxo’s reliability, speed, and ability to ship high-quality embedded services inside the KOHO app.

When KOHO sought to expand its platform with a remittance offering, Boxo’s trusted SDK and proven execution made it the clear choice. By building on the same mini-app infrastructure, KOHO could launch faster, maintain a consistent user experience, and continue its journey toward a broader super app strategy.

KOHO’s goal isn’t simply to add features—it’s to build a cohesive financial ecosystem. Boxo’s platform gives KOHO the flexibility to grow that ecosystem rapidly.

What’s Next: Expanding Payout Options

The current remittance experience focuses on bank transfers, but KOHO’s roadmap includes expanding into faster and more localised payout methods.

Through Nium, KOHO will be able to introduce:

Wallet-to-wallet transfers — GCash (Philippines), GoPay (Indonesia), DANA, OVO, and others

UPI transfers in India — enabling instant, low-cost payouts

Enhanced China options — bank transfers using Alipay-linked accounts

Deeper support in markets across Africa and Southeast Asia

These upgrades will reduce friction for recipients, shorten transfer times, and make KOHO more competitive in the global remittance space.

Conclusion

KOHO’s new remittance mini-app demonstrates what’s possible when a fintech pairs strong user demand with the right embedded-services platform. By launching with Boxo—and leveraging Nium’s global infrastructure—KOHO delivered a world-class cross-border money transfer experience without the typical build-from-scratch overhead.

With over 200 supported countries and regions, nearly 10 million CAD in processed volume, and thousands of users already adopting the feature, KOHO is now positioned as one of Canada’s most versatile consumer fintech apps.

And with wallet-to-wallet transfers, UPI, and expanded corridor coverage on the horizon, this is only the beginning of what KOHO and Boxo will build together.

Turn your app into a Super App

Boxo is on a mission to accelerate the adoption of Super Apps globally. We enable the seamless integration of a range of value-added services, such as marketplaces, flight booking, and insurance, into any app. We deliver these services through pre-built, white-label miniapps across various sectors, such as E-commerce, Travel, Financial, and Lifestyle. Boxo currently works with 10 Super Apps worldwide, including GCash, Binance, Touch’N’Go, and VodaPay, and empowers more than 600 miniapp integrations, reaching a combined user base of over 500 million.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.