Binance and Abu Dhabi Global Market Formalise a New Model for Global Crypto Regulation

Editorial Team

•

Boxo

Crypto regulation is no longer a hypothetical future. It is happening in real time, market by market, with clearer rules, defined expectations, and increasing coordination between regulators and industry leaders.

In its latest regulatory commentary, Binance outlines how global frameworks are beginning to mature. The shift is subtle but important. This is no longer about whether crypto should be regulated, but how regulation can enable scale, trust, and mainstream adoption.

For builders, platforms, and product teams, this moment matters more than any headline about enforcement or compliance.

From grey zones to guardrails

For much of crypto’s history, innovation raced ahead of regulation. Products were built quickly, distributed globally, and often operated in legal grey areas. That model does not work at mass scale.

What we are seeing now is a transition toward clearer guardrails:

Jurisdictions defining licensing and operational standards

Rules around custody, consumer protection, and disclosures becoming more consistent

Regulators engaging directly with large platforms rather than reacting after the fact

This does not slow innovation. It changes where innovation happens. The advantage shifts from speed alone to reliability, compliance, and execution at scale.

Trust becomes a product feature

As crypto moves closer to everyday financial use cases, trust stops being abstract. It becomes a product requirement.

Users expect:

Clear rules on how their funds are held and protected

Transparent processes around payments, transfers, and conversions

Confidence that the app they use will still work tomorrow, in another country, under another regulator

Regulation helps create that baseline. For consumer-facing apps, this is not a constraint. It is an enabler of adoption.

Why this matters for superapps and embedded finance

The biggest opportunity created by regulation is not the oversight of exchanges or trading venues. It is what regulation unlocks downstream.

As rules stabilise, a much broader set of apps can safely embed financial services directly into their products. Payments and wallets no longer need to live in standalone financial apps. Cross-border money movement can become a native feature rather than a specialist workflow. On-chain rails can start powering everyday use cases, shifting crypto’s role away from speculation and toward utility.

This is why superapps tend to thrive in regulated environments. They sit at the intersection of trust and convenience. When users feel confident that embedded financial features are compliant, protected, and reliable, they are far more willing to use them frequently and across multiple contexts. Regulation, in this sense, does not slow adoption. It creates the conditions for it to scale.

Infrastructure over individual apps

The long-term winners in a regulated crypto environment are not just individual products. They are the platforms and infrastructure layers that make compliant innovation repeatable.

Instead of every app reinventing compliance, payments, or financial workflows, we are moving toward:

Modular financial capabilities

Embedded services that can be launched market by market

Shared infrastructure that abstracts complexity away from developers

This is how financial services scale on the internet. Crypto is now following the same path.

The bigger picture

Regulation is often framed as a threat to crypto’s original ethos. In practice, it signals that the industry has entered a new phase.

Speculation created awareness. Regulation creates durability.

As frameworks mature, the centre of gravity shifts from standalone crypto products to infrastructure that can be safely embedded into everyday apps. Payments, wallets, cross-border transfers, and on-chain rails increasingly need to operate within clear regulatory boundaries if they are to reach mass adoption.

This is where the opportunity opens up for superapps and embedded finance platforms. Rather than every app rebuilding financial capabilities from scratch, regulated infrastructure allows developers to plug compliant services directly into products users already trust and use daily.

At Boxo, this is the thesis. Crypto does not need more isolated apps. It needs to become invisible infrastructure powering real-world use cases inside existing ecosystems. As regulation brings clarity, the winners will be the platforms that make compliant, global financial services easy to embed, scale, and distribute.

That is where the next wave of adoption will come from.

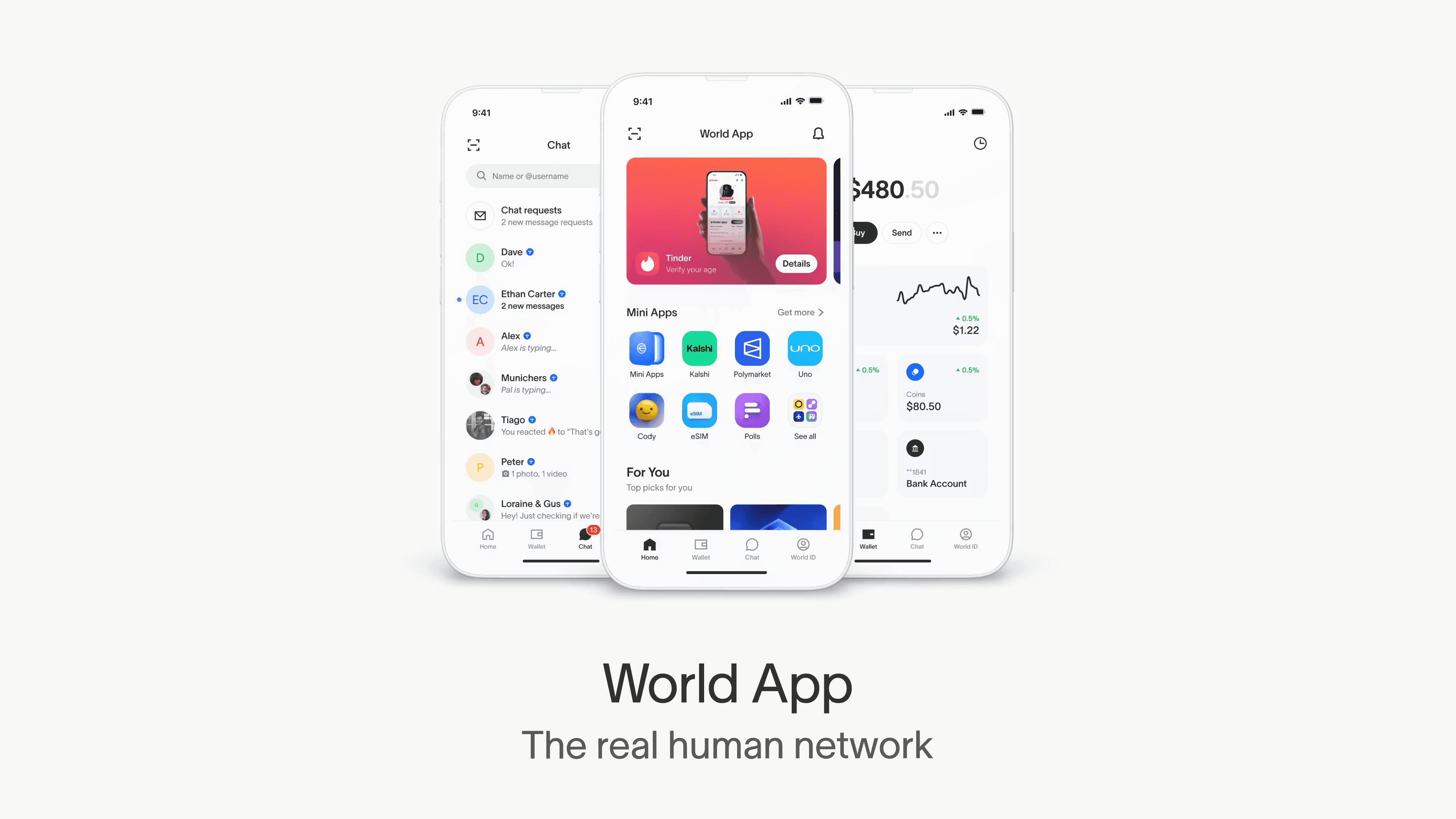

Launch Remittance, eSIMs, Travel, and More with Boxo

If you’re looking to expand your app’s capabilities, Boxo makes it effortless to embed high-value services through one SDK. From global eSIMs and cross-border remittance to airport lounges, bill payments, and travel utilities, Boxo’s mini-apps plug directly into your existing product with a unified UX and fully managed backend. We handle the complexity — supply partners, settlement, compliance, and fulfilment — so you can focus on growth, retention, and delivering seamless user journeys. Turn your app into a multi-service ecosystem with Boxo’s mini-app platform.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.