USDC Enters the Banking Stack Through Visa

Editorial Team

•

Boxo

Visa Quietly Turns Stablecoins Into Bank Infrastructure

Visa has begun enabling U.S. banks to settle transactions using Circle’s USDC on Solana. While the announcement may read like another crypto integration, the substance points to something more structural: stablecoins are now being treated as production settlement rails inside mainstream banking infrastructure.

This is not a consumer-facing crypto play. Card experiences remain unchanged. What is evolving is how value moves behind the scenes.

What’s happening?

✅ U.S. issuer and acquirer partners can now settle with Visa in USDC on Solana, following a pilot that processed approximately $3.5B in stablecoin volume

✅ Banks are already settling payments with Visa on Solana, with the pilot reaching an estimated $3.5B in volume as of 30 November

✅ Cross River Bank and Lead Bank are among the first U.S. banks live with USDC settlement

✅ Settlement now runs seven days a week, enabling faster, more predictable, and programmable liquidity management

✅ Visa is a design partner for Circle’s Arc blockchain, signalling deeper blockchain-native integrations ahead

From pilots to production rails

Visa has experimented with stablecoin settlement for several years, but this move marks a shift from isolated pilots to institutional deployment. By enabling USDC settlement directly between U.S. issuers and acquirers, Visa is positioning blockchain-native settlement as a complement to existing banking workflows rather than a replacement.

Solana’s role is intentional. Its throughput and low-latency finality make it suitable for payment-grade settlement, while Visa continues to abstract the underlying complexity away from banks. Institutions do not need to rebuild their stacks or expose end users to crypto rails in order to participate.

The card swipe stays familiar. The settlement layer evolves.

Why it matters

👉 Stablecoins are moving from speculative assets to production-grade financial infrastructure

👉 Visa is validating blockchain-native settlement at real banking scale, not at the edges of the ecosystem

👉 Always-on settlement reduces liquidity friction for banks and fintechs operating across time zones

👉 Programmable rails unlock new treasury, reconciliation, and capital efficiency models

👉 Legacy payment experiences remain unchanged, while the underlying rails quietly upgrade

Stablecoins as invisible infrastructure

The most telling aspect of this launch is how understated it is. There is no consumer rebrand, no requirement for users to hold USDC, and no disruption to existing payment experiences. Stablecoins are simply being embedded as a utility layer within the financial system.

This mirrors the evolution of the internet itself. Protocols became critical infrastructure long before users ever needed to understand them. Stablecoins are on the same trajectory.

Boxo take

This is what mainstream adoption looks like in practice. Incremental infrastructure upgrades that compound over time, rather than headline-grabbing consumer launches.

As banks, wallets, and superapps look to expand functionality without increasing friction, stablecoins are increasingly becoming the settlement layer that enables faster movement, global reach, and programmable money flows behind the scenes.

The future of payments is not crypto replacing cards. It is crypto quietly making the existing system work better.

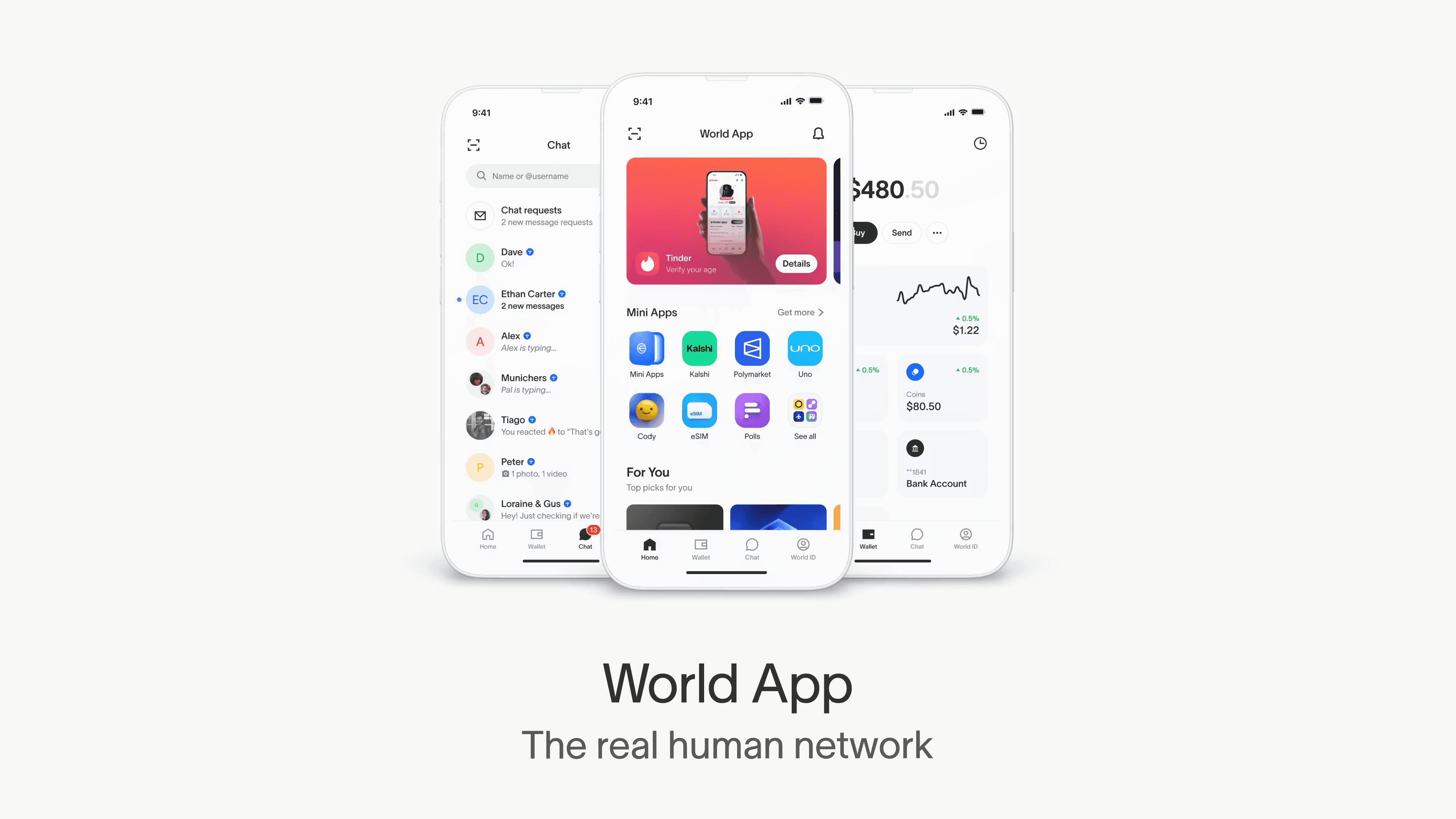

Launch Remittance, eSIMs, Travel, and More with Boxo

If you’re looking to expand your app’s capabilities, Boxo makes it effortless to embed high-value services through one SDK. From global eSIMs and cross-border remittance to airport lounges, bill payments, and travel utilities, Boxo’s mini-apps plug directly into your existing product with a unified UX and fully managed backend. We handle the complexity — supply partners, settlement, compliance, and fulfilment — so you can focus on growth, retention, and delivering seamless user journeys. Turn your app into a multi-service ecosystem with Boxo’s mini-app platform.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.