ASEAN’s Mobile-First Digital Economy Is Accelerating the Future of Embedded Finance

Editorial Team

•

Boxo

A new HSBC × Google Cloud report delivers one of the clearest pictures yet of Southeast Asia’s digital trajectory — and it confirms what builders on the ground have felt for years:

ASEAN is becoming the global blueprint for mobile-first, embedded financial ecosystems powered by real-time payments, AI, and tokenised value.

By 2030, the region’s digital economy is projected to reach US$2 trillion. This growth is not being driven by traditional enterprises alone, but by a young, mobile-native population and a vast wave of digital entrepreneurs shaping new financial behaviours at scale.

1. ASEAN Is Fundamentally a Mobile-First Region

The report surveyed 2,436 respondents across six ASEAN markets — Singapore, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines — and the results reveal one of the most mobile-centric consumer bases in the world:

99% own a smartphone

83% have a digital wallet account

75% shop online

This isn’t “mobile adoption.” This is mobile dependency.

In markets like Indonesia, Vietnam, and the Philippines, mobile is the primary (and often only) point of internet access, shaping how every service — from shopping to payments to travel — is consumed.

This behaviour creates ideal conditions for:

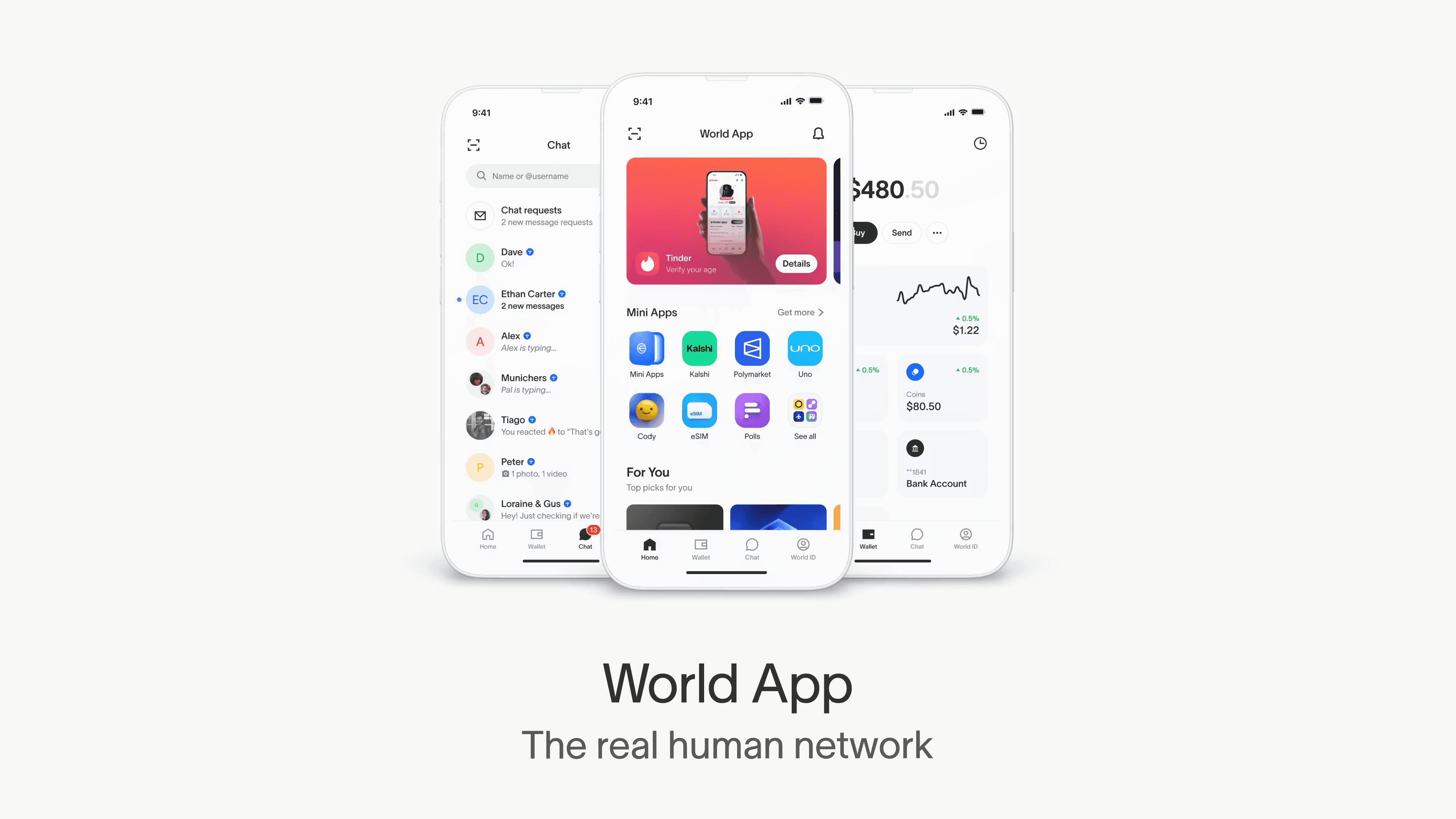

Mini-app ecosystems

Embedded finance

In-app credit

Messaging-led commerce

Platform-driven financial utilities

ASEAN didn’t move from desktop to mobile.

It moved straight to mobile → super-app → embedded finance.

2. Digital Entrepreneurs Power the Ecosystem

ASEAN’s economic transformation is being accelerated by its digital seller base:

Digital entrepreneurs already generate 58% of the region’s digital economy

Their gross transaction volume is projected to grow from US$175 billion in 2025 to US$580 billion by 2030

61% of these entrepreneurs are under 35, highlighting the region’s young, digital-native creator class

This group depends heavily on mobile-first financial infrastructure:

Instant payments

Embedded credit

In-wallet settlement

Cross-border rails for inventory

Micro loans inside platform ecosystems

For this segment, financial services are not separate destinations — they are tools embedded inside commercial platforms.

3. Embedded Finance Is Already Everyday Behaviour

ASEAN is one of the world’s most advanced embedded finance regions.

Key adoption markers from the report:

77% of consumers use embedded financial services

24% use embedded finance every time they shop online

Speed (67%) and security (57%) are the top payment decision drivers

Account-to-account (A2A) payments are rising rapidly and overtaking cards in multiple markets

Between ride-hailing apps, telco apps, e-commerce platforms, digital banks, and super-app ecosystems, embedded finance has become the default UX.

Consumers don’t ask for embedded finance.

They expect it.

4. Stablecoins Are Emerging as Cross-Border Infrastructure

ASEAN’s economy is highly cross-border by nature, with millions depending on remittances, SME import/export cycles, and regional supply chains.

The report highlights stablecoins and tokenised settlement as a major future rail:

Rapid settlement

Lower FX friction

Reduced reliance on correspondent banking

Singapore’s regulatory clarity accelerating adoption

Tokenised flows positioned to influence B2B, remittance, and SME invoicing

Global stablecoin settlement now regularly exceeds US$1 trillion per month, and the technology is increasingly aligned with ASEAN’s cross-border reality.

By 2030, regional cross-border payment flows are expected to double — and stablecoins are likely to play a foundational role.

5. AI Is Unlocking a New Layer of Financial UX

The report reveals a crucial behavioural signal:

73% of ASEAN consumers trust — or at least don’t distrust — AI in managing aspects of their finances.

This readiness paves the way for:

AI-powered budgeting and financial coaching

Intent-based auto-commerce (bookings, payments, top-ups)

Fraud detection and transaction scoring

Agentic workflows inside mini-apps

Personalised credit recommendations

Smart, context-aware financial utilities

HSBC also forecasts that up to 70% of Asia-Pacific businesses will be affected by agentic commerce and programmable money by 2026.

In ASEAN — mobile-first, platform-centric, and digitally native — AI is not an add-on.

It is the next interface layer for financial services.

What This Means for Banks, Telcos, Wallets, and Platforms

The strategic implications are significant:

Financial services must be embedded inside the apps people already use

AI will shift financial behaviours from reactive to automated

Stablecoins will strengthen cross-border liquidity and value transfer

Mini-app ecosystems will outpace monolithic super-apps in speed and scalability

Mobile-first UX is no longer a preference — it is the baseline

Digital entrepreneurs will continue shaping financial product demand

Platforms that treat finance as a contextual layer — not a standalone product — will win.

Boxo’s View

Across our work with digital banks, telcos, wallets, and consumer platforms, we see the same consistent pattern:

Users want services — travel, payments, connectivity, remittances — delivered directly inside the apps they already trust.

Mini-app ecosystems are the fastest and most scalable way to deliver this future.

Sources:

https://www.about.hsbc.com.sg/news-and-media/hsbc-and-google-cloud-report

https://fintechnews.sg/121797/singapore-fintech-festival-2025/hsbc-google-cloud-asean-digital-economy-report/?utm_source=chatgpt.com

Launch Remittance, eSIMs, Travel, and More with Boxo

If you’re exploring how to bring instant, low-friction cross-border transfers to your users, Boxo’s Remittance Mini-App offers a turnkey path. With a single SDK integration, any bank, telco, wallet, or fintech can embed compliant remittance flows directly inside their existing app — no new downloads, no fragmented UX, and no heavy engineering lift. Boxo handles the complex parts behind the scenes: partner settlement rails, FX, user verification, and a modular UI that fits naturally into your product. Whether you want to serve migrant workers, gig-economy earners, or travellers abroad, Boxo gives you the infrastructure to launch high-trust, high-velocity remittances in a matter of weeks, not quarters. Give your users the ability to send money home as easily as sending a message — powered by Boxo.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.