How Europe’s New Euro Stablecoin Could Redefine Digital Payments

Editorial Team

•

Boxo

Qivalis and the Future of Digital Money in Europe

In late 2025, ten of Europe’s largest banks — including ING, UniCredit, and BNP Paribas — announced Qivalis, a new consortium launching a regulated euro-pegged stablecoin in 2026.

It marks a shift: traditional banking institutions are no longer observing digital assets from the sidelines — they are building the rails themselves.

Qivalis aims to create a euro-denominated digital money layer designed for instant, low-cost payments across borders. In a region where digital settlement often depends on U.S. dollar stablecoins or fragmented domestic systems, a bank-backed euro token could reset the foundation of Europe’s financial UX.

A Bank-Backed Stablecoin with Superapp Potential

Qivalis represents something fundamentally different from earlier stablecoin experiments: it is not emerging from a crypto-native startup but from Europe’s most established financial institutions. This alone changes the equation. When banks with decades (or centuries) of regulatory oversight, consumer trust, and infrastructure commit to a digital euro, the product arrives with built-in legitimacy. Instead of battling scepticism, it slots naturally into financial workflows that enterprises, regulators, and users already understand.

More importantly, Qivalis is explicitly designed for real-world payment flows — peer-to-peer transfers, merchant settlement, cross-border commerce, remittance, and programmable financial operations. It is not a trading instrument or yield vehicle; it is infrastructure. If executed well, it gives Europe a high-velocity digital money layer capable of supporting the same user behaviours and platform innovations that accelerated the rise of Asia’s superapps.

Why This Matters for Europe’s Digital Ecosystem

A regulated euro stablecoin unlocks a set of advantages that Europe’s fragmented payments landscape has long struggled to deliver:

A native payment rail aligned with the euro, lowering FX friction

Instant, cross-border settlement across EU markets

Higher regulatory clarity compared with foreign-denominated stablecoins

A programmable foundation for wallets, commerce, and financial miniapps

A catalyst for superapp-style experiences that rely on fast, predictable payments

The Superapp Angle: Rails Shape Ecosystems

Superapps grow fastest when payments become frictionless. With a bank-backed euro stablecoin, European builders finally gain a unified rail that removes currency friction, settlement delays, and cross-border complexity.

Once payments are cheap and predictable, it becomes easier to embed high-frequency services — mobility, travel, commerce, financial miniapps — inside a single user experience. Qivalis could be the catalyst that allows European platforms to follow the same ecosystem expansion patterns seen in Asia.

What This Signals for Builders

For startups, fintechs, and platforms, Qivalis is more than a new token — it’s a signal that Europe’s digital money layer is about to open up. It creates space for product patterns that were previously too complex or costly to implement:

Stable, euro-denominated digital money lowers the barrier to embedded finance

Cross-border commerce and remittance become simpler to offer

Programmable payouts enable new user and merchant experiences

Wallet-centric journeys become easier to build and monetise

Ecosystems can expand horizontally without rebuilding payments each time

Where Boxo Fits: Connecting Digital Money to Real Utility

Boxo enables apps to evolve into multi-service ecosystems by embedding high-intent services — eSIMs, insurance, bill pay, lounges, remittance — directly inside their existing interface. A stablecoin like Qivalis enhances this model by providing a programmable euro layer that supports instant settlement, cross-border flows, and more seamless commerce inside miniapps.

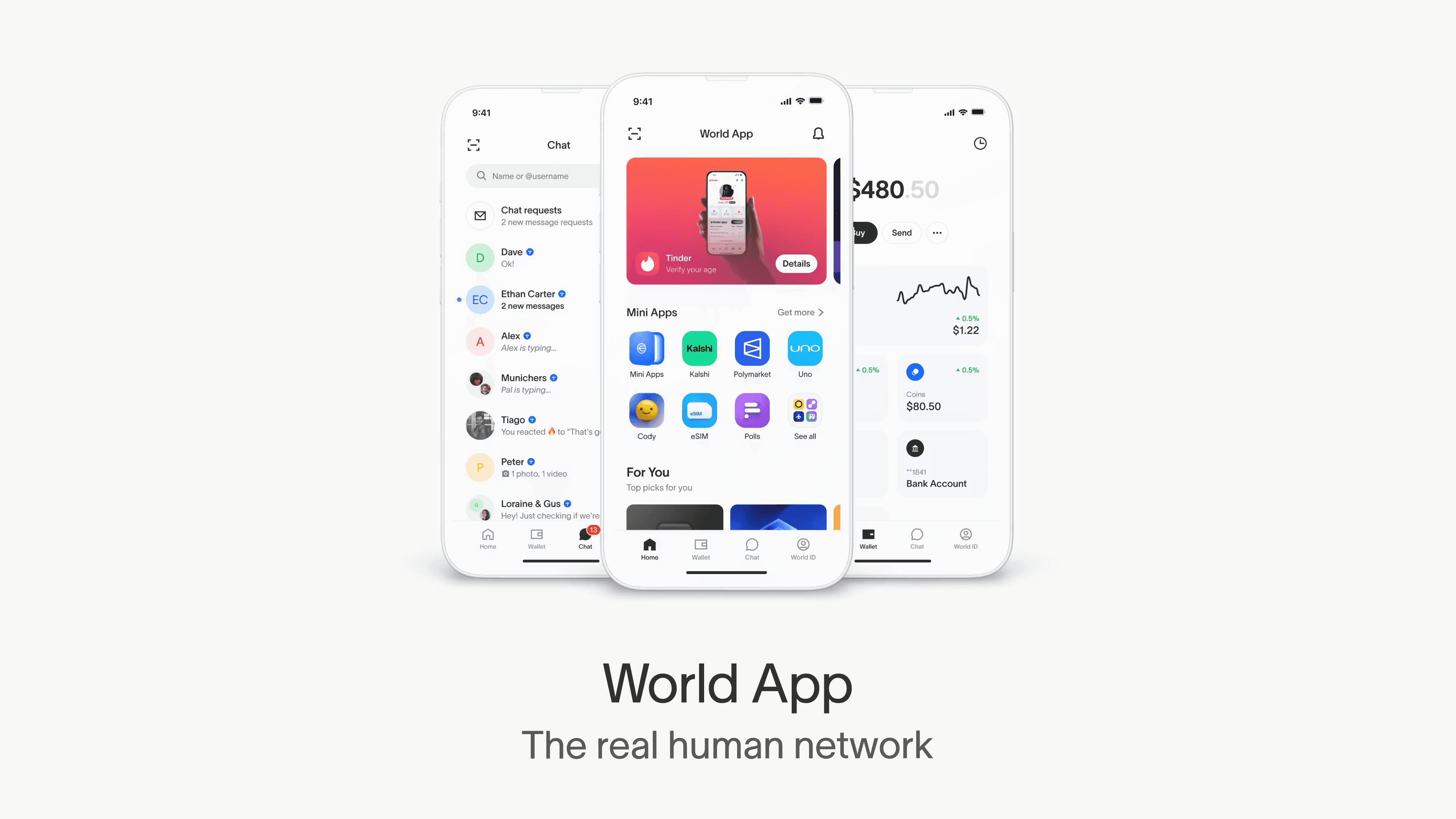

Beyond traditional finance, Boxo already works with crypto-native companies like World, helping bring real-world utility to on-chain assets so they can be spent, redeemed, and embedded into everyday experiences.

Qivalis signals a future where regulated digital money, embedded finance, and multi-service apps converge. Boxo gives any app the infrastructure to participate — and thrive — in that future.

Launch Remittance, eSIMs, Travel, and More with Boxo

If you’re looking to expand your app’s capabilities, Boxo makes it effortless to embed high-value services through one SDK. From global eSIMs and cross-border remittance to airport lounges, bill payments, and travel utilities, Boxo’s mini-apps plug directly into your existing product with a unified UX and fully managed backend. We handle the complexity — supply partners, settlement, compliance, and fulfilment — so you can focus on growth, retention, and delivering seamless user journeys. Turn your app into a multi-service ecosystem with Boxo’s mini-app platform.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.