How WhatsApp Remittances Are Redefining Embedded Finance in Latin America

Editorial Team

•

Boxo

In Latin America, remittances are not just financial transfers — they are family support systems and national economic pillars. In several countries, inbound remittances account for over 20% of GDP, making speed, accessibility, and affordability critical. Against this backdrop, the recent collaboration between dLocal and Félix Pago — enabling instant, stablecoin-powered remittances via WhatsApp — is a milestone that reveals where global super-app design is heading.

For companies building digital ecosystems, including those leveraging Boxo’s mini-app platform, this development shows how embedded finance should work: seamlessly, contextually, and invisibly.

WhatsApp as a Financial Interface

The power of this integration lies in its simplicity: users can send money within WhatsApp, the most ubiquitous communication tool across Latin America. Instead of directing users to download a standalone app, learn a new interface, or complete a lengthy onboarding flow, the remittance process begins in a chat window they already use daily.

This approach reflects the central super-app principle:

put services into existing behaviours rather than creating new ones.

With WhatsApp serving as the “home screen of the region”, embedding remittances inside conversations drastically lowers friction, increases trust, and shortens the journey from intent to transaction.

Stablecoins as the Invisible Engine

Behind the familiar chat interface is a next-generation settlement layer. Transfers are funded using USDC stablecoins, allowing cross-border settlement in minutes instead of hours or days. Yet users never touch crypto themselves. They:

Send funds in their home currency

Trigger a stablecoin-backed transfer behind the scenes

Deliver local currency into the recipient’s bank account

By abstracting away all blockchain complexity, the experience feels as simple as sending a message — while benefiting from improved speed and lower cost structures.

This principle is essential in modern fintech design:

use emerging technology to improve the backend, not to burden the user.

Why This Matters for Remittance-Heavy Economies

The initial rollout targets Mexico, Guatemala, Honduras, and El Salvador, some of the world’s most remittance-dependent corridors. These regions often deal with slow, fragmented cash-based services and high fees.

Embedding remittances inside WhatsApp solves three core pain points:

1. Faster settlement

Messages delivered instantly — and now, money too. Tests show transfers completing in under two minutes.

2. Lower cost to serve

Stablecoin rails reduce reliance on expensive correspondent banking intermediaries.

3. No added learning curve

Recipients receive funds in local currency without needing to install apps or understand crypto.

In emerging markets, where trust and simplicity drive adoption, reducing cognitive load may matter even more than reducing fees.

The Blueprint for Super-App Expansion

Beyond the remittance use case, the integration demonstrates several principles that define successful super-app strategies:

1. Embed value, don’t inflate feature lists

It’s not about adding services — it’s about placing the right service exactly where the user needs it. A remittance inside a WhatsApp chat is the clearest form of contextual relevance.

2. Collapse the distance between intent and outcome

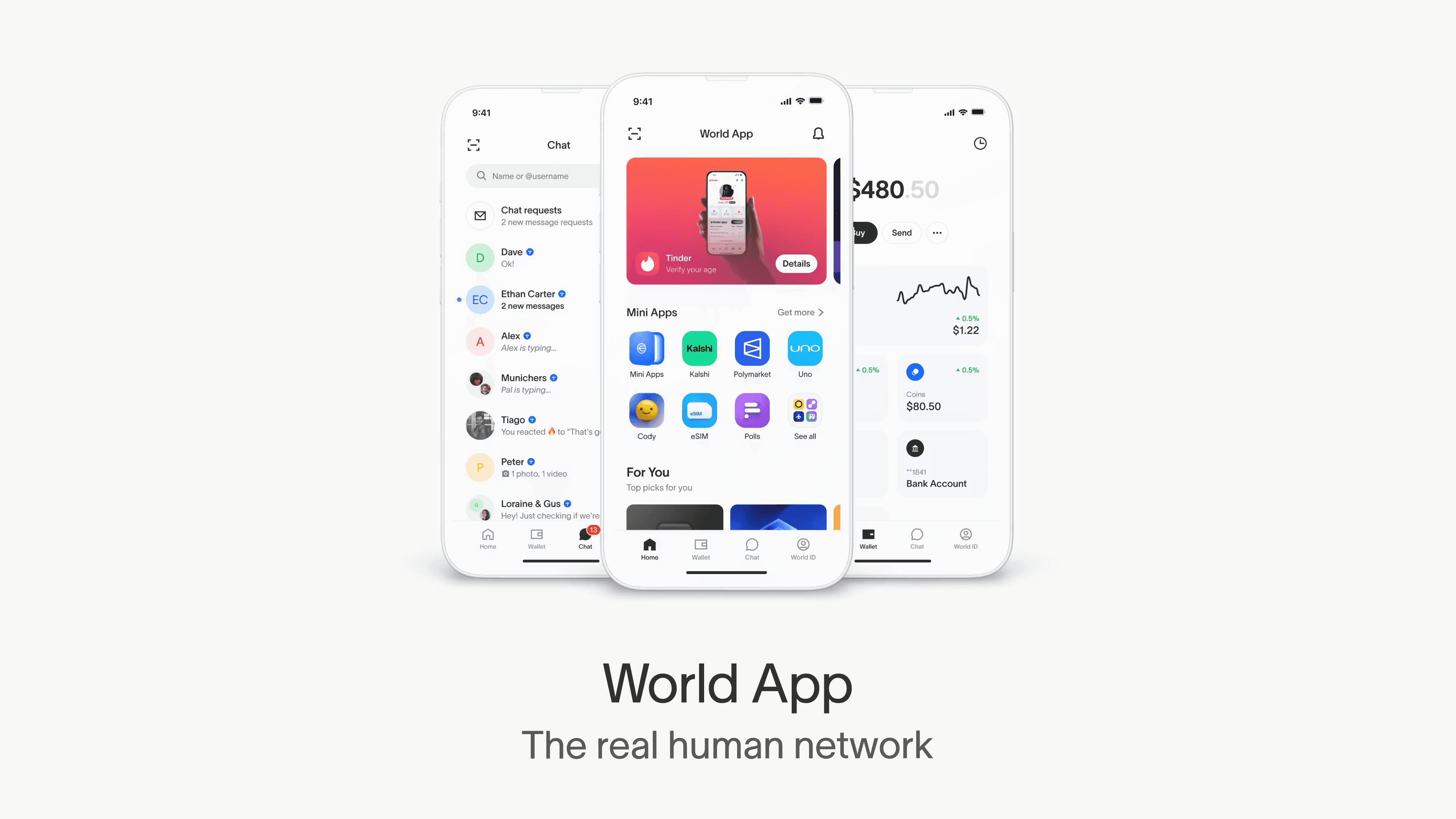

The fewer steps between “send money” and “recipient receives money”, the greater the adoption curve. This mirrors what Boxo enables across travel, eSIMs, bill pay, and remittance mini-apps.

3. Hide complexity behind elegant interfaces

Users shouldn’t need to know how a stablecoin works to benefit from it. This same philosophy powers Boxo’s SDK, where complex flows (connectivity, travel, payments) appear as simple, modular utilities inside any host app.

4. Build for emerging markets first

Latin America, Southeast Asia, and Africa aren’t “secondary” markets; they are where mobile-first behaviours and super-app economics evolve fastest. WhatsApp remittances are a product designed for real conditions in these regions — not retrofitted from Western assumptions.

Why Boxo Is Paying Close Attention

Boxo’s mission is to make super-app capabilities accessible to any platform — telcos, digital banks, fintechs, wallets, and consumer apps. The dLocal–Félix Pago rollout is a powerful validation of the approach Boxo champions:

Meet users where they already spend their time

Reduce onboarding friction

Use advanced infrastructure (like stablecoins or global supply rails) behind the scenes

Enable services that appear naturally within user journeys

Whether it’s eSIM activation during a travel booking, lounge access during airport transit, or remittance flows within a wallet app, the future belongs to experiences that feel native, contextual, and immediate.

The WhatsApp model shows how deeply financial services can embed into everyday interactions when the right infrastructure, interface, and regional insight align.

The Takeaway: Super-Apps Win Through Invisibility

The most powerful digital services are those users barely notice — because they simply work.

When a user can message a WhatsApp bot, send money home in seconds, and have their family receive it instantly in local currency, it no longer feels like “fintech” or “crypto”. It feels natural. And when a service feels natural, adoption becomes inevitable.

This is the direction Boxo is building toward: a world where any app can become a super-app, and essential services emerge exactly when and where the user needs them — no extra friction, no extra apps, just intelligent, embedded value.

Launch Remittance, eSIMs, Travel, and More with Boxo

If you’re exploring how to bring instant, low-friction cross-border transfers to your users, Boxo’s Remittance Mini-App offers a turnkey path. With a single SDK integration, any bank, telco, wallet, or fintech can embed compliant remittance flows directly inside their existing app — no new downloads, no fragmented UX, and no heavy engineering lift. Boxo handles the complex parts behind the scenes: partner settlement rails, FX, user verification, and a modular UI that fits naturally into your product. Whether you want to serve migrant workers, gig-economy earners, or travellers abroad, Boxo gives you the infrastructure to launch high-trust, high-velocity remittances in a matter of weeks, not quarters. Give your users the ability to send money home as easily as sending a message — powered by Boxo.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.