Klarna’s New Stablecoin Could Reshape Cross-Border Payments and Remittance

Editorial Team

•

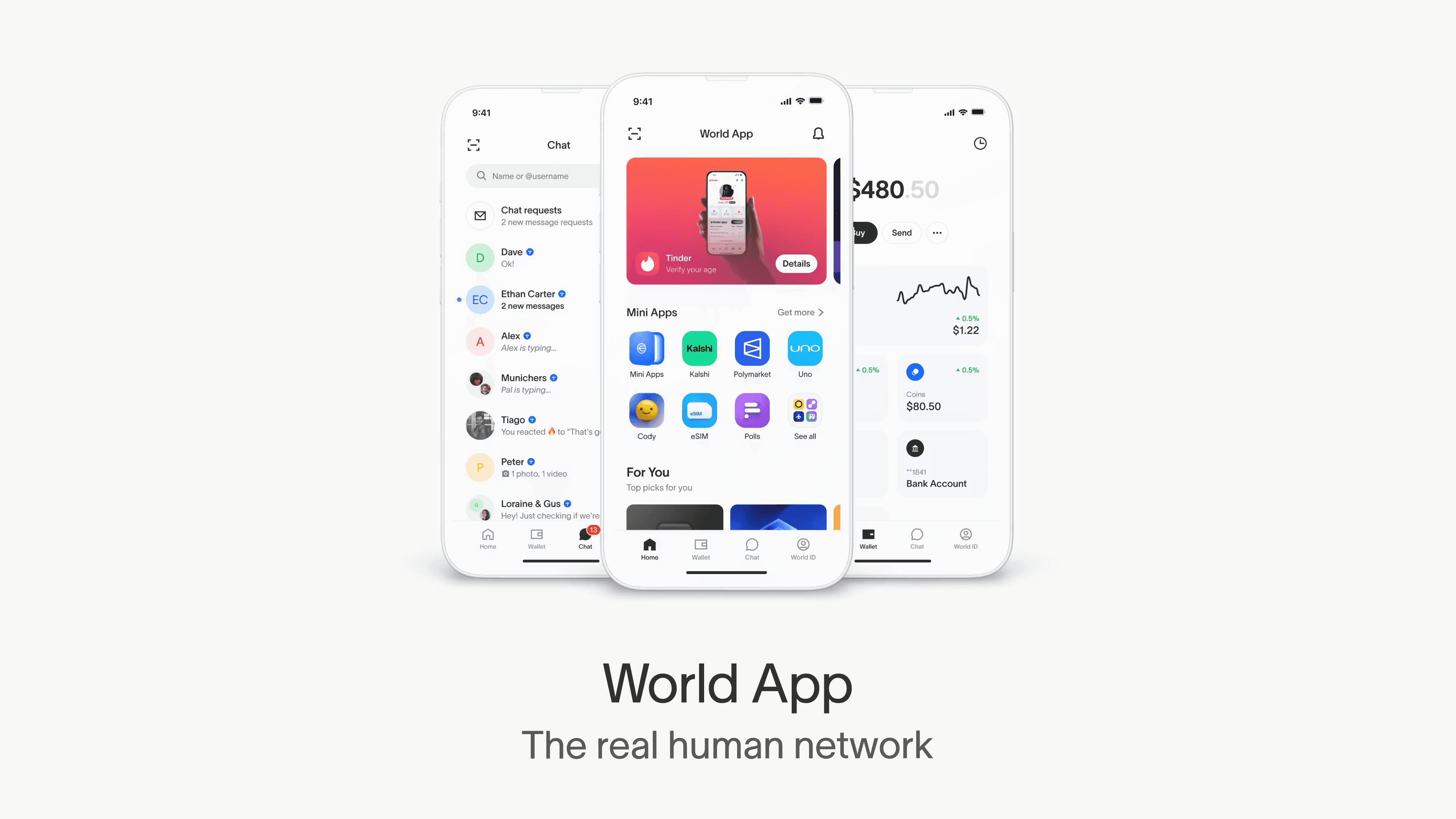

Boxo

Klarna Enters the Stablecoin Race and Signals a New Direction for Digital Payments

Klarna has announced the launch of a dollar-backed stablecoin, a move that places one of Europe’s largest consumer fintechs directly into the rapidly evolving world of digital money. This is not simply a product extension. It reflects a broader shift in global payments where the line between traditional fintech and crypto-native infrastructure continues to blur.

For years, stablecoins were viewed as speculative or niche. Today, they are becoming an accepted settlement layer for consumer platforms that need faster, cheaper, and more predictable movement of funds across borders. Klarna’s entry suggests that mainstream payment companies are now ready to adopt these rails directly rather than through third-party providers.

Why Klarna’s Stablecoin Matters

Klarna operates in more than 40 markets and has deep exposure to cross-border transactions, FX inefficiencies, and settlement delays. A dollar-backed stablecoin gives Klarna the ability to reduce costs, streamline flows, and potentially create a unified value layer across all markets.

Three strategic signals stand out:

1. Consumer fintechs are becoming issuers, not just integrators.

The launch shows that large platforms want direct control over settlement speed, capital efficiency, and user experience.

2. Stablecoins are becoming a competitive tool.

In regions with slow local rails, the ability to move value instantly and programmatically will matter just as much as UX or rewards.

3. Payments and digital wallets are converging with blockchain rails.

Users do not need to know that a stablecoin is involved. They only care that transactions arrive instantly, cost less, and work everywhere.

Klarna’s move is part of a wider global pattern where major consumer brands are positioning themselves for a digital money future.

What This Means for Superapps and Digital Wallets

For superapp builders, digital wallets, and multi-market platforms, Klarna’s decision is a strong signal. Stablecoins are becoming part of the payment stack, not an alternative to it.

The implications are clear:

Cross-border flows will speed up.

Settlement costs will decline.

Apps will be able to offer near-instant value transfers across regions.

Users will expect stable, consistent pricing without FX surprises.

This aligns closely with how superapps in Asia already think. The goal is not to expose users to crypto. The goal is to reduce friction, increase finality, and support global usage without relying on slow legacy rails.

Boxo’s View: Stablecoins Strengthen the Embedded Finance Layer

At Boxo, we build miniapps that help platforms deliver connectivity, payments, remittance, and travel services within their existing app. Klarna’s move reinforces a shift we see across partners: services must operate consistently across borders, regardless of where users are or which rail is underneath.

Stablecoins help achieve this by providing:

A predictable unit of account

Instant settlement

Lower operational overhead

A unified cross-market value layer

As more consumer platforms integrate or issue stablecoins, the embedded finance layer becomes more capable. Payments become faster. Remittance becomes cheaper. Travel services like eSIMs become easier to pair with cross-border spends. Users get a simpler, more intuitive experience without switching apps or methods.

Klarna’s launch is not the end point. It is the starting signal for a new competitive landscape where the most successful platforms will combine trusted UX with next-generation settlement rails.

The Path Forward

Digital payments are entering a new era. Traditional fintechs are adopting the speed and efficiency of blockchain. Superapps are integrating more cross-border services. Users expect apps to follow them across markets without breaking.

Klarna’s stablecoin is another milestone in this transition, and it will not be the last. The next phase of competition will be defined by platforms that can unify payments, movement of value, and high-intent services into a single, cohesive experience.

If you would like a LinkedIn version or a Twitter thread based on this post, I can generate it next.

Source: https://www.reuters.com/business/finance/klarna-launch-dollar-backed-stablecoin-race-digital-payments-heats-up-2025-11-25/?utm_source=chatgpt.com

Launch Remittance, eSIMs, Travel, and More with Boxo

If you’re looking to expand your app’s capabilities, Boxo makes it effortless to embed high-value services through one SDK. From global eSIMs and cross-border remittance to airport lounges, bill payments, and travel utilities, Boxo’s mini-apps plug directly into your existing product with a unified UX and fully managed backend. We handle the complexity — supply partners, settlement, compliance, and fulfilment — so you can focus on growth, retention, and delivering seamless user journeys. Turn your app into a multi-service ecosystem with Boxo’s mini-app platform.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.